Saving is hard, its boring, and most people lack the discipline to reach their goals. We get that, and that’s why we came up with Cashare App.

Cashare makes saving easier, exciting, and motivates you to save by facilitating rotating

savings and credit associations (ROSCA).

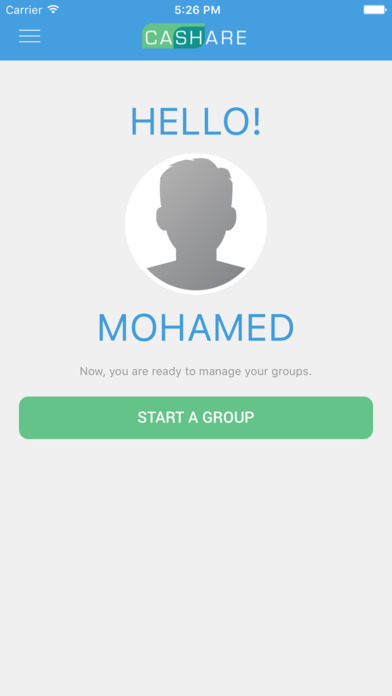

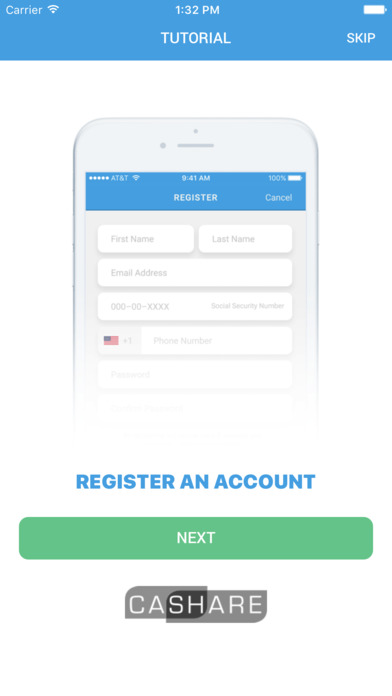

You begin by inviting coworkers, friends or family members to join you in your Cashare savings group.

Every group member contributes the same amount of money to the pool.

One group member takes that whole lump sum once.

Next period every group member contributes the same amount of money to the pool again, but a different person takes the lump sum.

The process is repeated till everyone gets the lump sum.

Cashare is a platform that facilitates ‘ROSCA’, a rotating savings and credit association, which is a group of individuals who agree to join for a defined period of time in order to save and borrow together.

It is a form of combined peer to peer banking and peer to peer lending.

It has been described as "the poor mans bank, where money is not idle for long but changes hands rapidly, satisfying both consumption and production needs."

Structure

It starts by inviting acquaintances and forming a group.

Each member contributes the same amount at each meeting, and one member takes the whole sum once. As a result, each member is able to access a larger sum of money during the life of the ROSCA, and use it for whatever purpose she or he wishes. This method of saving is an excellent alternative to the challenges of saving alone.

The system is a model for transparency and simplicity since every transaction is clear and understood by every member.

The individuals in the ROSCA select each other, which ensures that participation is based on trust and social forces, and a genuine commitment to participate.

In addition, since no money has to be retained inside the Cashare group, the money is transferred automatically and directly to the member collecting the funds.

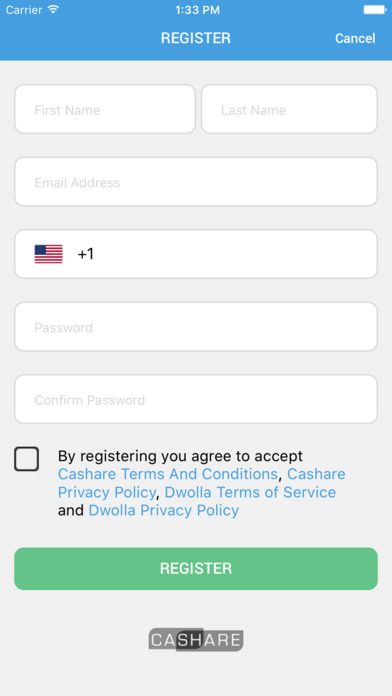

The system further reduces the risk to members by verifying each member identity and personal banking information.

Furthermore, each member receives the amount collected once, and once every member has collected there is the option to renew the cycle with a different order of payout, typically each member advancing one position, which is an incentive to be towards the end of the cycle.

Diversity

They are also known as tandas (Latin America), partnerhand (West Indies), cundinas (Mexico), hagbad (Somaliland), susu (West Africa and the Caribbean), hui (Asia), Game’ya (Middle East), kye (계) (South Korea),tanomosiko (頼母子講) (Japan), pandeiros (Brazil), juntas or quiniela (Peru), C.A.R. Țigănesc/Roata (România), arisan (Indonesia).

Variously called "committee" in India and Pakistan, Ekub in Ethiopia, Susus in Southern Africa and the Caribbean, "Seettuva" in Sri Lanka, tontines in West Africa, tanomoshiko or mujin in pre-1945 Japan, wichin gye in Korea, arisan in Indonesia, likelembas in the Democratic Republic of the Congo, xitique in Mozambique and djanggis in Cameroon,

In Brazilian consorcios, groups of strangers are assembled into a ROSCA unit by an agent or intermediary, whose role is to facilitate and administer the groups. As of 2015, over five million active ROSCA users were reported in Brazil.